AstraZeneca’s $1.05 billion takeover of Amolyt shines spotlight on rare disease research

Eneboparatide as a treatment for hypoparathyroidism

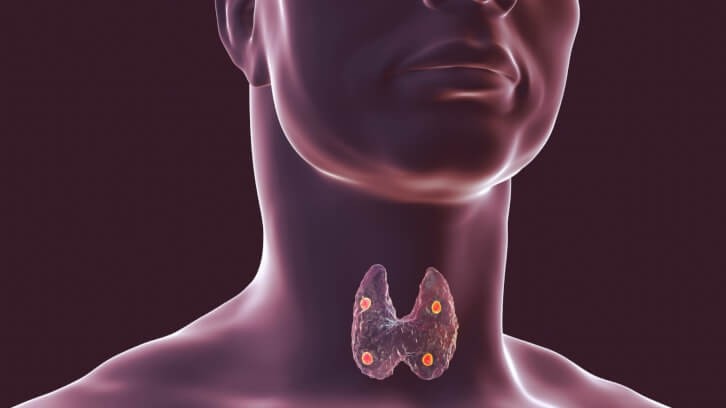

In hypoparathyroidism, the parathyroid glands do not produce enough parathyroid hormone, which is important for the regulation of calcium and phosphorus levels in the blood. Causes of the disease include damage to the glands during surgical procedures, autoimmune conditions, radiotherapy and genetic conditions.

Eneboparatide is a peptide drug designed to activate a cell surface protein called parathyroid hormone receptor 1 (PTHR1) and mimic the actions of parathyroid hormone. The treatment is delivered to the patient via daily subcutaneous injections.

AstraZeneca has acquired the French firm Amolyt Pharma in a $1.05 billion deal to bag its rare disease-focused pipeline including eneboparatide, a phase 3-stage treatment for hypoparathyroidism.

As part of the deal, Amolyt’s shareholders gain a total of $800 million upfront in addition to a potential payment of $250 million once an undisclosed “regulatory milestone” is hit. The acquisition is due to close in the third quarter of 2024 depending on regulatory clearance and other closing conditions.

“Chronic hypoparathyroid patients face a significant need for an alternative to current supportive therapies, which do not address the underlying hormone deficiency,” said Marc Dunoyer, CEO of Alexion, AstraZeneca Rare Disease in a public statement. He added that the big pharma’s rare disease-focused group is “uniquely positioned to drive the late-stage development and global commercialisation of eneboparatide, which has the potential to lessen the often debilitating impact of low parathyroid hormone and avoid the risks of high-dose calcium supplementation."

Innovation needed in hypoparathyroidism treatments

Patients with hypoparathyroidism cannot produce enough parathyroid hormone, a hormone vital for controlling blood calcium and phosphorus levels. This leads to low levels of calcium and high levels of phosphorus in the blood, with symptoms including muscle cramps, pain and twitching in addition to complications such as chronic kidney disease.

Injected subcutaneously every day, Amolyt’s eneboparatide is designed to activate a cell surface protein called parathyroid hormone receptor 1 (PTHR1), mimicking the function of the hormone. Topline results from a clinical trial of the therapy are expected in early 2025.

There are several other treatments in clinical development in the hypoparathyroidism space. One late-stage contender is Ascendis Pharma’s palopegteriparatide (TransCon PTH), which was approved in the EU but rejected by the US Food and Drug Administration last year based on concerns over manufacturing controls. Ascendis has reapplied for market approval in the US, with a decision expected by May 2024.

AstraZeneca also gets hold of the result of Amolyt’s pipeline, including the phase 1-stage peptide drug AZP-3813, which blocks the action of growth hormone in acromegaly. Topline data from an ongoing clinical trial are expected later this year.

AstraZeneca's portfolio expansion

AstraZeneca has also been on the lookout for other rare disease treatments to add to its portfolio. For instance, the big pharma took over the genomic medicine specialist LogicBio Therapeutics in 2022, and bought up preclinical-stage gene therapies and enabling technology from Pfizer for up to $1 billion last year.

Other big pharma companies are also snapping up rare disease treatments in recent years, with Novartis buying Chinook Therapeutics for $3.2 billion last year and Sanofi acquiring Inhibrx for $1.7 billion earlier this year.

In addition, Amgen acquired Horizon Therapeutics for $27.8 billion in 2022, though it took a legal settlement with the Federal Trade Commission to push the deal through due to fears of the move being anticompetitive.