One in the eye for Lucentis? Pfenex says Pfizer takeover will benefit Hospira pact

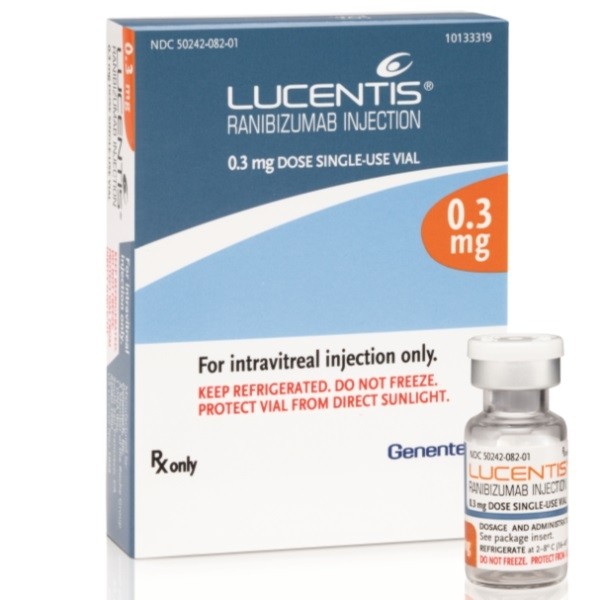

Pfenex partnered with Hospira to develop PF582, an antibody fragment copycat of Genentech’s wet AMD drug Lucentis (ranibizumab) last night. The deal earned the San Diego, US-based firm $51m (€45m) upfront, a potential $342m in milestones and royalties on future sales.

Spokeswoman Cassidy Cantin told BioPharma-Reporter.com “Hospira is now responsible for completing the clinical development of the product. Following technology transfer to Hospira in 2015 we expect the Phase 3 clinical trial to begin in 2016.”

News of the PF582 accord came days after Pfizer announced it planned to buy Hospira for $17bn, citing the firm’s standing in the biosimilars sector as one of the major reasons for the deal.

Cantin confirmed that: “Pfizer was aware of this transaction and has publicly stated its excitement regarding Hospira’s recombinant protein biosimilars pipeline.”

She added that: “Pfizer brings significant economic and commercialization resources to this program and we believe this only enhances the potential for success.”

Pfizer was more cautious telling us “we expect to better understand Hospira’s biosimilar programs in the coming months. Given where we are in the process, it would be premature to comment further.” The firm also reiterated that the Hospira takeover is subject to shareholder approval.

We asked Roche, Genentech's owner, what impact a Pfizer-backed Lucentis rival will have on the market but the Swiss firm told us "we do not speculate or comment on actions of other companies."

Pipeline and platform

Candidates in Pfenex’s pipeline are produced using its Pseudomonas fluorescens-based production platform, which was originally developed by Mycogen and then by Dow following its acquisition of the latter in the 1990s.

Other biosimilars include versions of Roche’s Pegasys, Pfizer’s Genotropin, UCB’s Cimzia and Sigma-Tau’s Oncaspar and Bayer’s Betaseron that Pfenex is developing with Agila Biotech. The firm also has an agreement with Ranbaxy to work on an undisclosed copycat biologic.

William Blair analyst John Sonnier welcomed Pfenex’s agreement with Hospira, suggesting it cuts the newly public firm’s capital risk.

He also cited the Pfizer deal and US regulatory developments as an illustration of the growing importance of biosimilars and the companies like Pfenex that develop them in the world’s largest pharmaceutical market.