FDA ‘breakthrough’ scheme approves GSK biologic, but is it faster?

GSK’s Arzerra (ofatumumab), authorised in combination with chlorambucil for previously untreated chronic lymphocytic leukaemia (CLL), is the fourth drug, and the second biologic after Roche’s Gazyva, to receive marketing authorisation via the FDA’s latest pathway, Breakthrough Therapy Designation (BTD).

Under the 2012 FDA Safety and Innovation Act (FDASIA), BTDs are intended to encourage the development of biologics and non-biologics to treat serious diseases with an unmet need when early clinical evidence shows the drug may be a “substantial” improvement on available therapies.

The process includes all the features of the FDA’s Fast Track programme, but also includes intensive guidance from the agency throughout the drug’s clinical development, potentially as early as Phase I trials, and including during the IND (investigational new drug) Application.

But is it faster?

However it is too early to tell whether the BTD process helps get products to market faster than via alternative routes, said Saurabh Aggarwal, founder of Novel Health Strategies, a consultancy which advises Big Pharma on new product launches, pricing and market access.

The FDA’s three other schemes are Fast Track Designation, Accelerated Approval Pathway, and Priority Review Designation.

The products approved so far “came into the process for BTD a bit late,” Aggarwal told BioPharma-Reporter.com. “They were already in late stage trials when the process was created. So it’s tough to generalise if the approval timings were based entirely on the breakthrough designation pathway.”

But the FDA has a good track record with other acceleration programmes, he told us.

“To give some credit to the FDA there are some products which were approved very fast in the past through other schemes, so the FDA has in the past shortened the timeline for approval for products if they showed really good efficacy. That point is sometimes ignored that the FDA has taken steps in the past to make sure that highly efficacious products are approved early.”

The best indicator of whether the programme truly helps get drugs approved early, he said, would be to follow the futures of those which have recently joined the BTD pathway in Phase I or early Phase II.

BTD prices could ‘break the country’

Since the pathway was created in 2012, 41 drugs have received BTD designation out of 155 applications. Pharmaceutical companies have chosen to reveal only 31 of the successful submissions.

Before Arzerra, three BTD drugs had reached the market: Roche’s Gazyva (obinutuzumab), to be used with chlorambucil for previously untreated CLL; Pharmacyclics and Janssen Biotech’s Imbruvica (ibrutinib) for CLL and mantle cell lymphoma; and Gilead’s Sovaldi (sofosbuvir) for chronic Hepatitis C.

The pricing of BTD drugs is an important trend to watch out for, Aggarwal told us. The three BTD products on the market “all came with quite significant premium, in the range of 25 to 50%, compared to products which were already on the market.”

In a paper in Nature, he estimated Gazyva as costing $49,000 (€35,500) per course, Sovaldi as $84,000 (€61,000) per course and Imbruvica as $130,000 (€94,000) per year. This pricing would place Imbruvica as 30% more expensive than the “standard” for cancer therapies, he said.

The US pharmacy giant Express Scripts has threatened to boycott Sovaldi over its high price once alternatives are approved next year. The company’s Chief Medical Officer Steven Miller told Bloomberg if every US patient with Hepatitis C was treated with Sovaldi, the cost would exceed $300bn (€217bn) and “break the country.”

The high prices could be due to the cachet of the Breakthrough Therapy Designation, Aggarwal told BioPharma-Reporter.com.

“In some senses it suggests that since a top regulatory agency like FDA is endorsing these products as ‘breakthrough’ maybe that could also be a reason why manufacturers are taking the chance to price these products at a much higher level.”

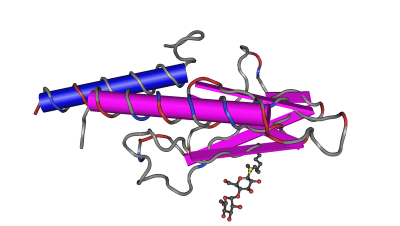

Biologics now comprise 32% of all products in the BTD programme, making them greatly overrepresented among breakthrough therapy designations. (Large molecules make up around 17% of global pharmaceutical sales.) This is partly because biologics, as expensive, infused therapies, tend to target the sorts of serious and complex diseases covered by the BTD programme, said Aggarwal.