Merck KGaA is latest bi-curious antibody developer in ADC deal with Sutro

The deal – which will see Sutro receive an unspecified upfront payment and milestones of €230m ($298m) – will focus on using the San Francisco, US-based firm's “cell free” production technology to develop ADCs for multiple cancer targets.

In addition to development work, Sutro has also been tasked with manufacturing supplies of any candidate antibodies for Phase I trials that are initiated as a result of the collaboration.

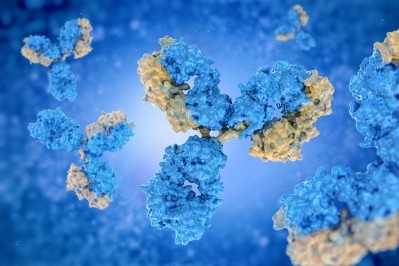

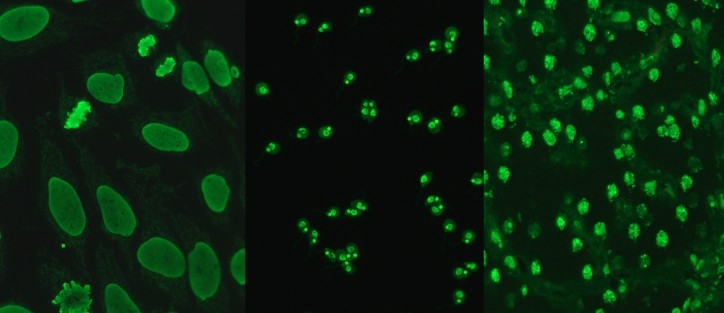

The cell-free system, as the name suggests, does not rely on cellular expression of a gene encoding a particular antibody.

Instead, Sutro’s approach is to use cellular components outside the cell in conjunction with amino acids, enzymes and metabolites to produce antibodies chemically, which the firm claims eliminates the variation inherent to cell-based expression systems.

The other advantage, according to Sutro, is that it can assemble individual components into antibodies that are capable of binding several epitopes, which means any ADCs create have a broader range of precisely selected therapeutic targets.

This capability was highlighted as key to the Merck deal by Sutro CEO William Newell, who said: “Our technology has been developed to allow loading of an antibody with multiple different agents and to enable a potential higher uptake of the drug in the tumor cell through improved stability of the ADC.”

Bispecific

To date the only approved bispecific antibody is the cancer treatment Removab, which is made Fresenius Biotech and Trion Pharma. However, according to data from market research organisation Root Analysis over 50 dual targeting antibodies are currently being developed.

Lead analysts Shivani Singh predicted that, as a result of increasing interest and a rich and diverse product pipeline, worth at least $4.4bn a year by 2023 with growth being driven by “seven drugs which are currently in advanced clinical trials.”

Other firms involved in bispecific antibodies include Ambrx, which teamed with China’s Zhejiang Hisun in May, and Eli Lilly, which has been looking at Genmab’s Duobody production platform since January this year.