Abzena to buy TCRS in latest boost to its ADC offering

The proposed acquisition is the second in three months for Cambridge, UK-based Abzena after the technology provider bolstered its biologics services in September by buying CDMO PacificGMP.

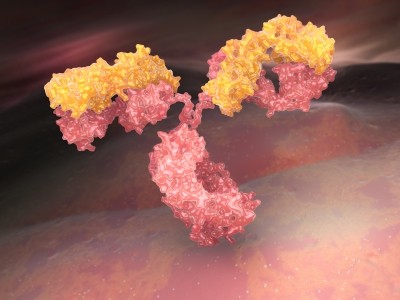

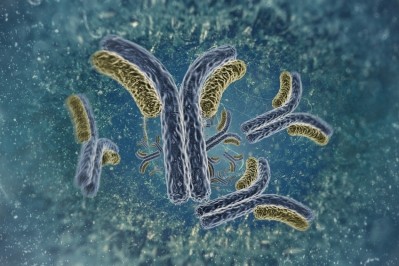

The $15m (€14m) addition of Philadelphia, Pennsylvania-based TCRS “brings complementary experience in manufacture of ADCs and also has reagents for conjugation as well as a variety of highly potent payloads for advancing customer ADC projects,” Abzena CEO John Burt told this publication.

The deal also adds capacity for ADC production and expands the firm’s geographic footprint.

“The fact that TCRS is located in the US is important for us as it is where many of our partners are located,” Burt said. “It also brings the Group operations on the East coast in a key life sciences hub, which complements the West coast location of our PacificGMP business.”

Strategic growth

This latest acquisition is also an “important strategic step in our ambition to build Abzena into a self-sustaining business and ‘partner of choice’ for R&D organisations developing biopharmaceutical drugs,” he continued, and N+1 Singer senior research analyst Jens Lindqvist agreed

“In my view it certainly confirms Abzena’s intentions in the bio-conjugation space, where they will now be able to capture a much larger part of the value chain,” he told Biopharma-Reporter.

PacificGMP added third-party services focusing on developing and manufacturing mAbs, recombinant proteins, vaccines and gene therapies, but while that deal “could possibly be described as a nifty bolt-on,” Lindqvist added “TCRS is a bigger company and the acquisition is materially valuation accretive.”

The firm raised £20m ($30m) to help fund the acquisition through a secondary sale of existing shares arranged in part by N+1 Singer.

ADC opportunities

A number of CDMOs have invested in ADC technologies over the past few years – Carbogen Amcis, Catalent, Fujifilm, Lonza, Novasep, to name a few – but there are currently only two such products commercially available: Seattle Genetics/Takeda’s Adcetris, and Genentech’s Kadcyla.

Lindqvist told us the risk of investing in such technology “is higher than for ‘standard’ monoclonal antibodies,” but on the positive side there are around 50 ADCs currently in clinical trials, the regulatory pathway is clear, and “it is an area where I believe Abzena’s linker technology could make a real difference.”

Burt added that “biopharma firms are still investing in ADC technology and there is a lot of potential there. We are already seeing good traction with partners using our proprietary ThioBridge technology and expect this to continue and to see partner products entering the clinic.

“For Abzena, continued progress in the ADC area will build on today’s agreed acquisition and the capabilities that it brings.”